What Forecasts and Trends to Expect from the Manufacturing Industry in 2022

Paul Reilly

Chief Commercial Officer

There is one constant in the dynamic world of manufacturing: change. The pace of change has accelerated at breakneck speed since March 2020 when the industry - and society as a whole - was hit by the full force of the Covid-19 pandemic. Suddenly faced with lockdown restrictions that precipitated supply chain issues, labour shortages and inflation, manufacturers' resilience, agility and robustness was severely tested.

The tide began to turn for the sector in 2021 amid the global vaccine rollout and rising demand. For example, the final reading of the IHS Markit/CIPS UK manufacturing Purchasing Managers’ Index (PMI) for December was 57.9, close to November's three-month high of 58.1 - a reading above 50 indicates expansion in the UK’s manufacturing sector.

In the US, industrial production - which is based on the productivity of manufacturing alongside mining, and utilities - surpassed pre-pandemic levels in August 2021, according to data released by the Federal Reserve: manufacturing production increased by 0.2 points - 5.9 points better than the same point a year earlier and 1.0 point above its February 2020 level.

With the foundations laid for sustained growth, can the manufacturing industry build on its recent success in 2022? The answer is undoubtedly yes, but against a backdrop of workforce shortages and supply chain instability - which are reducing operational efficiency and margins - and the turbulence from an unusually quick economic rebound, challenges will arise.

Several trends are expected to colour the picture for the manufacturing sector in 2022 - from challenges such as ongoing supply chain constraints to opportunities like digital transformation.

Need to make currency payments

Workforce shortage

The manufacturing skills gap could have a vice-like grip on the sector in 2022 and beyond. For example, in the US the outlook is concerning: estimates suggest that this could create a shortfall of 2.1 million skilled jobs by 2030. In the near term, vast numbers of unfilled jobs could limit productivity and growth over the coming months - with 71% of manufacturers predicting that problems recruiting and retaining employees will continue beyond 2021.

Since the pandemic struck, the manufacturing industry has been presented with an intriguing scenario: vast numbers of people out of work, which coincided with a sudden increase in demand for manufactured goods. On the surface, this appears to be the sweet spot. If we scratch the surface, however, it becomes clear that despite the creation of jobs amid these conditions - April 2021 saw 916,000 jobs created in the US manufacturing sector alone - employers cannot find skilled workers to fill them.

Things are going to get worse before they get better judging by projections for the rest of the decade. So, what next? Manufacturers must bridge this labour gap by implementing strategies that attract and retain talent. This is an opportunity to reinvest in training, identify new talent pools and rethink the recruiting strategy.

Reinvestment in comprehensive training is a crucial factor for recruiting new talent and retaining skilled labour - something that was prevalent in the last century in the form of apprenticeships. Changing the public perception of manufacturing jobs by making them more desirable could be critical to meeting hiring needs moving forward. By engaging with a wider talent ecosystem of diverse, skilled individuals, manufacturers can begin to offset the recent wave of retirements and voluntary exits from the sector.

Senior decision-makers within the manufacturing industry must consider goals for retention, culture, and innovation through the lens of flexible working - exploring ways to imbue flexibility throughout their organisation. Addressing current, and preparing for future, workforce trends is vital to resolving the current talent shortage.

Supply chain instability

Supply chain challenges remain acute and are still unfolding - with several significant forces at play. The blow dealt to supply that started in China in February 2020, and the demand shock that followed as the global economy locked down, exposed systemic vulnerabilities in production strategies and supply chains. Consequently, manufacturers globally face prolonged disruptions that increase costs and test agility.

In the US, PMI reports continue to shed light on complications throughout the supply chain - from rising costs of raw materials and freight to high demand and slow deliveries. As demand outstrips supply, higher costs are more likely to filter down to consumers. These headwinds, combined with the US-China trade war, have triggered a rise in economic nationalism - a system whereby a country protects its economy by reducing the number of imports and investments from other countries.

In the UK, another factor has compounded the impact of the pandemic: Brexit. Britain’s exit from the EU has compounded supply shortages in the UK economy compared to the rest of the world, according to the Office for Budget Responsibility (OBR) - the government's spending watchdog. In documents released alongside the budget, the OBR pointed the finger at Brexit for these logjams:

"Supply bottlenecks have been exacerbated by changes in the migration and trading regimes following Brexit.”

Supply chain strategies in 2022 must, therefore, strive to increase domestic production, grow domestic employment, reduce or eliminate dependence on risky sources, and rethink the use of lean manufacturing strategies. Digital supply networks and data analytics can be powerful tools in the struggle to achieve improved efficiency and flexibility in response to disruptions.

Digital transformation

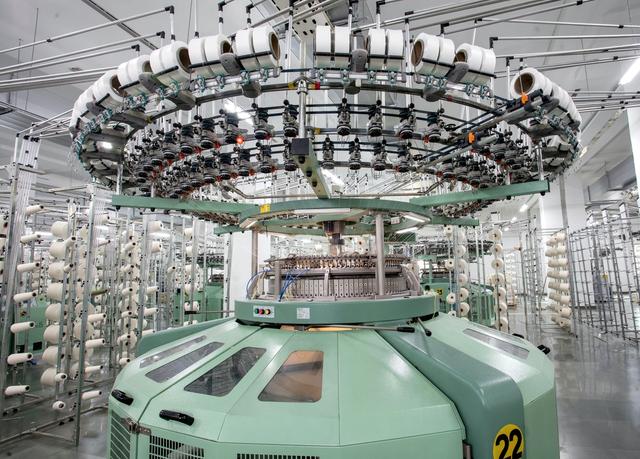

Manufacturers that failed to pivot from manual to automated processes during the Industrial Revolution found themselves obsolete - and history is repeating itself in the digital/artificial intelligence era. Manufacturers that lag digitally not only fall behind their competitors; they lack the agility to adapt during unforeseen events such as the global pandemic - threatening their very existence.

The potential benefits of increased investment in automation and digitisation in 2022 are compelling:

- Ease the impact of labour shortages.

- Adapt to periods of imbalanced demand.

- Empower the workforce to deliver on more critical tasks.

- Increased visibility into processes, scheduling and the supply chain to identify potential problems before they occur and make informed decisions in real-time.

To perpetuate worthwhile digital transformation in manufacturing, the adoption of technology must be a cultural transition, not just an operational investment. Organisations need to demonstrate to the workforce that manufacturing software is a means of empowering - not replacing - them.

By adopting more connected, reliable, efficient, and predictive processes, manufacturers can enhance efficiency and adaptability. Investment in artificial intelligence will provide the power to transform operations; while foundational technologies such as cloud computing will continue to enable digital visibility, scale, and speed. For example, for many manufacturers, smart factories - including greenfield and brownfield investments - are considered vital to achieving competitiveness.

Cybersecurity

Cyber incidents have been a major concern for businesses of all sizes - from SMEs to large corporations - for a number of years. However, the proliferation of cybercrime has been accelerated by the pandemic. No organisation in the manufacturing industry is immune from a potential attack, as has been demonstrated in recent months by a spike in pandemic-related cyber-attacks - elevating cybersecurity as a risk management imperative for executives and boards.

The escalation of this threat during the pandemic has been precipitated by an expanding attack surface amid enforced remote working, leaving manufacturers more susceptible to data breaches - with inefficiencies in legacy systems and technology exposed by sophisticated network challenges

As we move into 2022, manufacturers should consider cybersecurity holistically - both from a technical cyber defence perspective and a business resilience viewpoint. Data breaches aren’t the only threat; cybercriminals are also capable of shutting down operations and disrupting entire supplier networks.

Never has it been so important to adopt a proactive approach to cybersecurity. As the pandemic subsides and businesses stabilise, manufacturers must not be complacent about cybersecurity. They can’t afford to respond reactively to these sophisticated – and constantly evolving – threats; they must develop a cybersecurity strategy that establishes and implements proactive and meaningful security controls and culture.

Via a secure payments platform

ESG investment

Since it was first mentioned in the United Nation’s Principles for Responsible Investment report in 2006, ESG (environmental, social and governance) has evolved from a public relation, box-ticking exercise into a vital evaluation of an organisation’s collective conscientiousness for social and environmental factors - redefining and elevating sustainability in manufacturing in the process.

Today’s ethically conscious society has prompted a shift in workforce and consumer expectations, causing manufacturers to make their ESG efforts more visible. The benefits of satisfying these metrics extend beyond making a profit: top-line growth, cost reductions, reduced regulatory and legal interventions, employee productivity uplift, investment and asset optimisation.

From delivering against net-zero or carbon-neutral goals to achieving diversity, equity, and inclusion, manufacturers will benefit from implementing a robust ESG strategy that collects the right data - demonstrating to auditors, investors, and regulators that they are actively addressing these issues and tracking progress. This should be underpinned by governance, risk and compliance software that supports the full ESG spectrum. This ability to track, monitor and report from a central point of oversight offers a holistic view of ESG - establishing an ethical and sustainable model that satisfies regulators and attracts business.

Currency risk exposure

As Covid-19 restrictions ease and manufacturing activity rebounds, significant challenges remain, but opportunities will also present themselves - not least the opportunity to save money when making international payments amid pandemic-fuelled currency market volatility. As manufacturing businesses that operate internationally adjust to the new normal and plan for the future, they must be acutely aware of the need to manage their exposure to currency risk.

Currencies are traded around the clock - 24 hours a day. Therefore, the value of the pound against other currencies is constantly changing - not just daily but by the minute. Why do they fluctuate in value? Currencies strengthen and weaken each day because banks and investors purchase huge volumes in response to political and economic news. Positive news about a country typically causes the value of the currency to rise (“strengthen”), while bad news causes it to fall (“weaken”).

We also know when they might move because we often know the timing of political events that might influence them, and the economic calendar shows us when influential economic data will be released. However, there will also be news that happens without warning - anything from a US president tweeting late at night to a fall in the price of bauxite.

What we cannot predict – and no one can – is whether they will move up or down or by how much. Even slight fluctuations can make a big difference to the price of your business’s international payments. In some instances, the impact of the political and economic variables that influence exchange rates can be severe, as has been proved in recent times. For example, back in March 2020, when the true extent of the Covid-19 pandemic became clear, the pound sunk to its lowest level against the dollar since 1985 and its lowest level against the euro since the depth of the financial crisis 11 years earlier.

Before the pandemic struck, this exposure to currency market risk had the potential to dent your bottom line if left unaccounted for. Since then, however, the importance of mitigating the impact of exchange rate fluctuations on the cost of your international payments has been magnified. This has brought the need to seek the services of a currency specialist into sharp focus for many businesses in the manufacturing industry.

Clear Currency

Clear Currency specialises in helping businesses that are exposed to currency market risk save money when making international payments - both large and small.

Transferring large sums of money into another currency and transferring them overseas can be daunting and confusing. Aware of this, we use our knowledge and experience to cut through the jargon and provide you with a friendly and personal service.

We recognise that it’s impossible to accurately predict how exchange rates will perform; therefore, it’s prudent to plan for all eventualities. With this in mind, we will assign you a dedicated account manager. In addition to helping you benefit from quick, easy, reliable and secure transfers from our intuitive payments platform, they can help you mitigate the impact of currency risk on your international payments.

Your account manager will work in partnership with you throughout the international payment process. For example, a manufacturer that regularly transfers money overseas to pay suppliers will be faced with varying costs each month due to the dynamic nature of the currency market. Therefore, they will want to secure the most favourable exchange rate.

Because fluctuating exchange rates make it hard to judge how much you’ll pay at any one time, your account manager can help you execute a forward contract to secure the cost of your payments. This allows you to lock in an exchange rate for a date in the future, securing the price of your international payments when the time comes to execute them.

This dedicated currency specialist can also help you to plan and establish a proactive hedging strategy. There’s no “one size fits all” approach to protecting your bottom line from the threat of currency risk. Therefore, a bespoke hedging strategy that aligns with your requirements, commercial context, and risk appetite will allow your business to execute effective solutions that sync with its aims.

Related Articles

How to Mitigate Foreign Exchange Risk

Currency risk can have a significant effect on the efficiency and profitability of any international business. Each exchange rate movement affects how much you receive from sales and what you pay to suppliers.

Read more

Moving to Dubai from the UK: Checklist

You’re ready for a new life overseas and have decided you’re moving to Dubai. Now it’s time to consider the various costs involved, from your visa and accommodation, to health insurance, shipping your belongings and bringing your beloved pets along too.

Read more

Currency Outlook Quarter 1 2023

Clear Currency looks back at the performance of the US dollar, euro and sterling in Q4 2022, and assesses what might be in store for Q1 2023.

Read more