Currency Outlook Quarter 1 2023

Clear Currency looks back at the performance of the US dollar, euro and sterling in Quarter 4 2022, and assesses what might be in store for Quarter 1 2023.

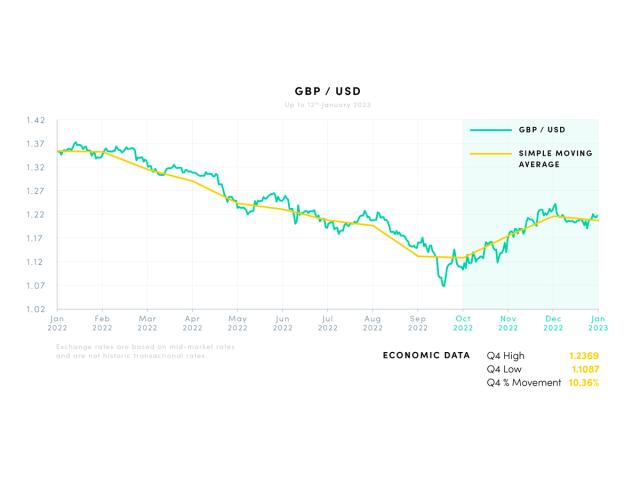

GBP (pound sterling)

The hangover from Liz Truss and Kwasi Kwarteng’s mini-budget lingered into the start of October, keeping GBP under pressure as we entered the final quarter of the year. Cable had hit record lows and the overall feeling was that the new PM may have gone a step too far. The backlash was so fierce that Kwarteng was sacked, replaced by a more traditional approach to economics in Jeremy Hunt. Truss resigned soon after, eventually succeeded by the third Prime Minister of the year, Rishi Sunak. Sunak and Hunt worked hard to calm markets and although the much-anticipated Autumn Budget painted a dire picture for the UK, the market reaction was muted. This can be credited in part to the pre-warning measures taken by the PM and Chancellor, something their predecessors sorely lacked. November’s rate hike of 75-basis points was the most aggressive seen in the UK for many years, but noises were already beginning to be heard on how much further the Bank of England could go in their fight against rising prices. The BoE’s forecast of a two-year long recession also did little to aid the pound. Relief came in the form of a weaker US dollar, softened by data suggesting the Fed’s work was beginning to bear fruit, helping GBP/USD to return towards the 1.20 level. December’s 50-point raise was seen as a dovish hike though, with two MPC members voting for no increase at all. The pound has struggled to build meaningful momentum since then.

The new year has started with markets still very unsure of sterling’s credentials. Of the G3 central banks, it looks as though the Bank of England may be the first to reach their peak of interest rates. While inflation does seem to be dropping, MPC votes are slowly turning towards smaller hikes, or no hike at all. February’s BoE meeting will be key to gauge the mood surrounding the pound. Even if the Bank of England do keep raising, their habit of accompanying action with downbeat forecasts may keep the pound subdued.

USD (US dollars)

Risk flows supported the dollar for much of 2022, pushing G3 currency pairs to lows rarely seen in decades. As Q4 began though, a shift was becoming evident. While risk-based flows were still observable, a return of focus to inflation figures and potential central bank action took over. These themes were not new, but the scrutiny that any data release would now come under was pushed to new levels. Dollar strength had gone hand in hand with aggressive Fed action, but as the market started to anticipate a pivot, the dollar’s grip on currency markets began to loosen. November’s hike of 75-basis points was the fourth of that quantity in a row, yet the dollar weakened, depressed by a drop in inflation figures that led the market to believe a softer stance was coming. The pressure of the market’s perception saw the US dollar index drop by 5.2% in November, its worst monthly performance in 12 years. December’s Fed meeting went as expected with a 50-point hike implemented, although Chair Powell was keen to express that while hikes may reduce in size, a restrictive environment may be required for longer than expected.Inflation figures, labour data, and the Fed action that accompanies them, will be the driving force for the dollar in the early stages of 2023. Markets seem keen to correct the large swings seen in the dollar from last year, but a return to the pre-invasion of Ukraine levels for GBP/USD and EUR/USD may be some way off. The US economy continues to function well, and the labour market is holding steady. Both would likely need to stutter before the dollar gives up major ground.

Create An Account

Sign up for an account today and get access to our fast and secure online payments platform.

EUR (euro)

The euro began Q4 trying to recover from the lowest EUR/USD rate seen in 20 years and a sustained period below parity against the dollar that had run since mid-August. The war in Ukraine and the knock-on effects on gas and energy continued to dominate euro movement, with macro data being largely ignored. Eurozone inflation hit 10.7% YoY for October and the prospects of a shallow recession were looking slim. The ECB remained hawkish though, raising interest rates by 75-basis points in November and warning markets that there was much more to be done if they were to return to their target of 2% inflation. This was followed by a further 50-point hike in December, partnered with a forecast of up to three further hikes of the same size in the first half of 2023. While the ECB were the last of the G3 central banks to act, they now seemed to be the most aggressive. The reward was a return towards the 1.05 handle for EUR/USD, a level far more familiar in recent times. A warmer winter resulting in less energy usage has also lent strength to the common currency.

The ECB’s hawkish stance has allowed for further gains for the euro as we start the new year. This talk will need to be backed up with firm action if the euro is to break new ground, or perhaps more accurately, regain ground lost since the Russian invasion of Ukraine. In line with the BoE and Fed, the tone of February’s ECB meeting will be closely watched for any hints of action outside of the general market consensus.

Keep Calm and Overcome the Volatility

If you’re looking for further information regarding mitigating the risk of your currency exposure, talk to the experts at Clear Currency. Our team of specialists can help keep you in the loop on FX tools to use to help your business stay profitable. We trade in over 35 currencies (including pound sterling, euro and US dollars) across 130 countries globally. Sign up for an account in minutes today, or to chat with one of our specialists, call +44 (0)20 7151 4870 or email hello@clearcurrency.co.uk.

Related Articles

How to Mitigate Foreign Exchange Risk

Currency risk can have a significant effect on the efficiency and profitability of any international business. Each exchange rate movement affects how much you receive from sales and what you pay to suppliers.

Read more

Moving to Dubai from the UK: Checklist

You’re ready for a new life overseas and have decided you’re moving to Dubai. Now it’s time to consider the various costs involved, from your visa and accommodation, to health insurance, shipping your belongings and bringing your beloved pets along too.

Read more

Cost of Living Comparison: UK and Portugal

If you’re daydreaming about laid back European life, endless sunshine and afternoons spent sipping coffee and eating one too many pastel de nata, it sounds like an overseas move to Portugal is on the cards. To help you make the most informed decision on your move abroad, you’ll want to have a strong understanding of the cost of living in Portugal.

Read more